Table of Contents

AI Tools for Crypto Investors

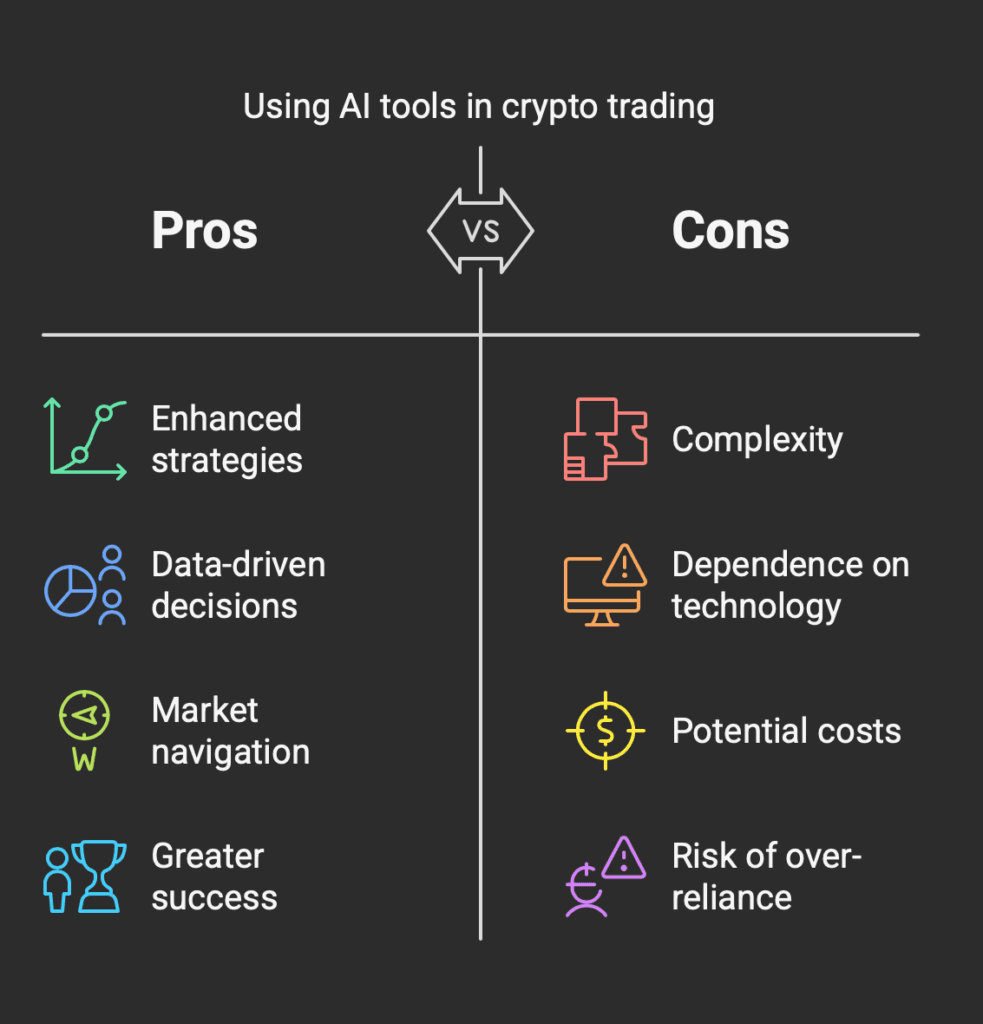

In the rapidly evolving world of cryptocurrency, investors are increasingly turning to artificial intelligence (AI) tools to enhance their trading strategies. This document explores various AI technologies that can assist crypto investors in making informed decisions, optimizing their portfolios, and navigating market volatility. By leveraging these advanced tools, investors can gain a competitive edge and improve their overall trading performance.

In today’s fast-paced crypto markets, understanding the intricate details of trading strategies can empower investors to make more calculated decisions. For instance, the implementation of AI tools not only streamlines trading but also enhances the investor’s capacity to predict market trends. By analyzing historical data alongside current market conditions, crypto investors can adjust their strategies in real-time, maximizing their potential for profit.

Understanding AI’s role in crypto trading also involves recognizing its potential to reduce emotional decision-making. Often, traders can fall prey to their emotions during market fluctuations, leading to impulsive actions. AI tools provide objective analyses, guiding investors to make data-driven decisions regardless of market euphoria or panic.

Understanding AI in Crypto Trading

Moreover, as AI technology continues to advance, its integration into crypto trading becomes increasingly sophisticated. Investors can access platforms that utilize deep learning algorithms to process vast datasets, uncovering hidden correlations and trends that traditional methods might overlook. This advanced analysis capability allows for the optimization of trading strategies based on accurate predictions rather than mere speculation.

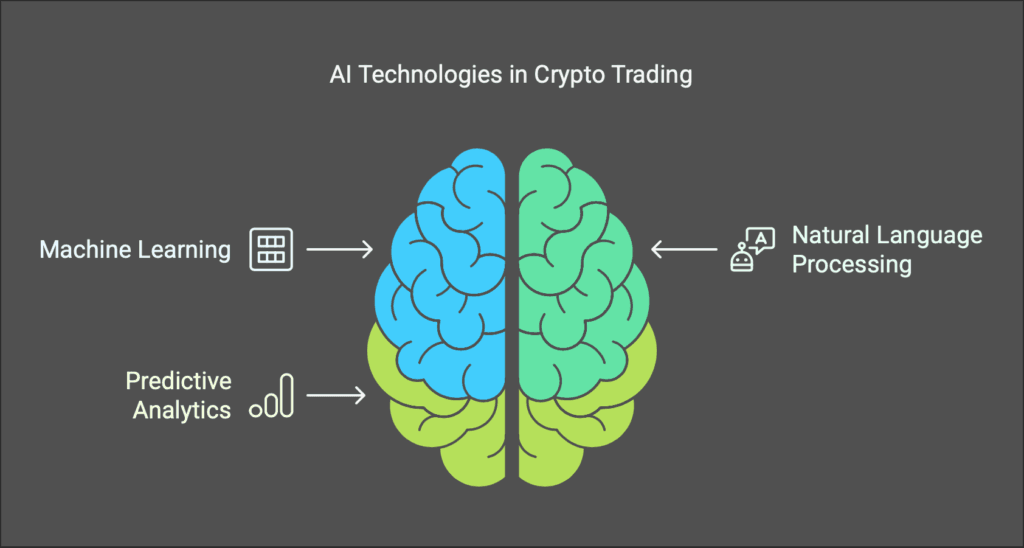

AI encompasses a range of technologies, including machine learning, natural language processing, and predictive analytics, which can analyze vast amounts of data to identify patterns and trends. In the context of cryptocurrency trading, AI can help investors by providing insights into market movements, sentiment analysis, and risk management.

Key AI Tools for Crypto Investors

1. Algorithmic Trading Bots

For example, algorithmic trading bots can execute trades on an investor’s behalf based on specific parameters, removing the emotional component entirely. This systematic approach ensures that trades are made based on logical and data-supported strategies rather than gut feelings.

Algorithmic trading bots are automated systems that execute trades based on predefined criteria. These bots can analyze market data in real-time, allowing investors to capitalize on price fluctuations without the need for constant monitoring. Popular platforms like 3Commas and Cryptohopper offer customizable bots that can be tailored to individual trading strategies.

2. Sentiment Analysis Tools

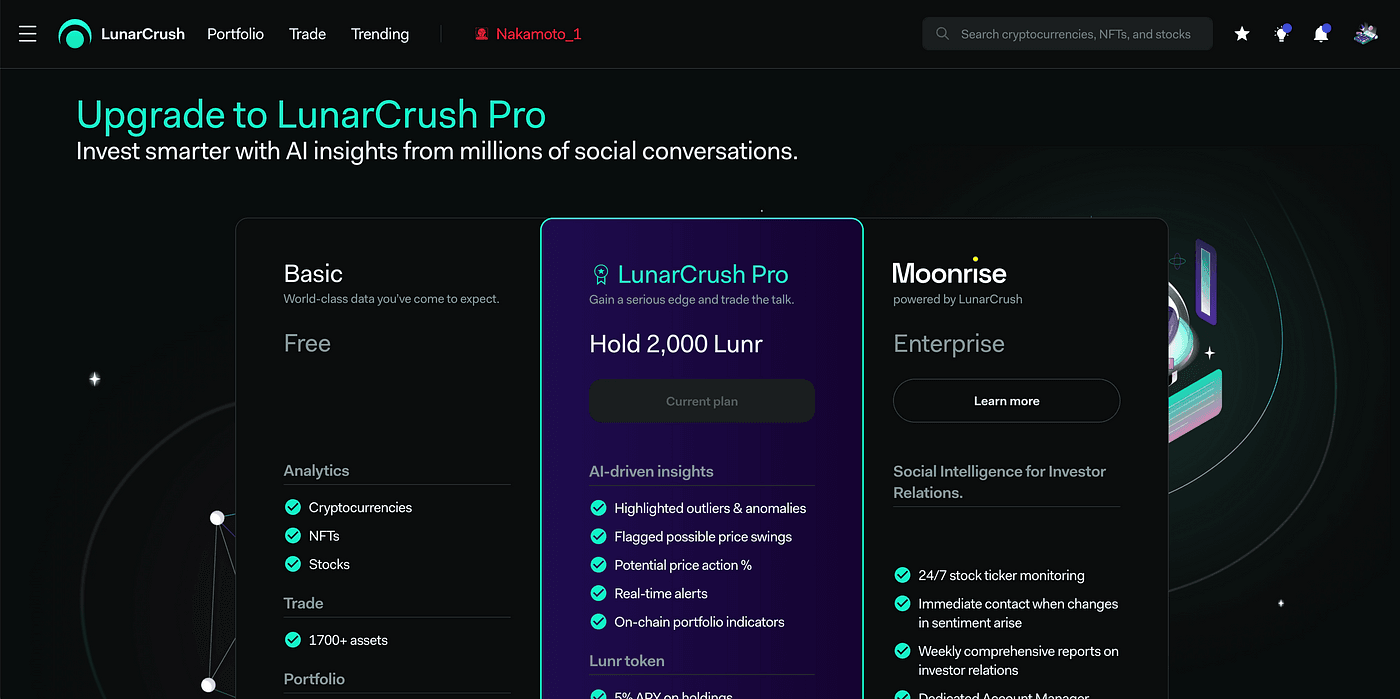

Sentiment analysis tools utilize natural language processing to gauge market sentiment from various sources, including social media, news articles, and forums. By understanding the prevailing sentiment around a particular cryptocurrency, investors can make more informed decisions. Tools like LunarCrush and The TIE provide valuable insights into market sentiment.

3. Predictive Analytics Platforms

Predictive analytics platforms use historical data and machine learning algorithms to forecast future price movements. These tools can help investors identify potential entry and exit points for their trades. Platforms such as Token Metrics and Santiment offer predictive analytics features that can enhance trading strategies.

4. Portfolio Management Tools

AI-driven portfolio management tools assist investors in optimizing their asset allocation and risk management. These tools analyze market conditions and individual asset performance to recommend adjustments to a portfolio. Services like Shrimpy and Altrady provide comprehensive portfolio management solutions for crypto investors.

5. Risk Assessment Tools

Understanding and managing risk is crucial in the volatile crypto market. AI-powered risk assessment tools can analyze an investor’s portfolio and market conditions to provide insights into potential risks. Tools like Riskalyze and Coin Metrics help investors assess their risk exposure and make informed decisions.

In Conclusion to AI Tools for Crypto

As the cryptocurrency market continues to grow and evolve, leveraging AI tools can significantly enhance trading strategies for investors. By utilizing algorithmic trading bots, sentiment analysis, predictive analytics, portfolio management, and risk assessment tools, crypto investors can make smarter, data-driven decisions. Embracing these technologies not only helps in navigating market complexities but also positions investors for greater success in the dynamic world of cryptocurrency trading. Thank you for reading about AI Tools for Crypto for more great topics checkout